What option will not be available if you are behind on loan payments? When you’re behind on loans, the one option that vanishes like smoke is getting another loan. Your credit score takes a hit, making lenders see you as a risky borrower and slamming the door on new loans and lines of credit. While other options like refinancing or deferring might still be on the table, they’ll likely come with less favorable terms. Remember, communication with your lender is key! They can guide you towards the finest solution to get back on track and out of the “no new loans” zone.

What option will not be available if you are behind on loan payments?

The option that most likely will not be available if you are behind on loan payments is:

Table of Contents

Obtaining another loan or line of credit:

What option will not be available if you are behind on loan payments? When you miss loan payments, your credit score takes a hit, and you become a higher-risk borrower in the eyes of lenders. It makes it highly unlikely for them to approve you for additional credit.

Here are some other options that may impacted but are not necessarily unavailable, depending on the severity of your delinquency and the specific lender:

- Refinancing your current loan: While some lenders may consider refinancing even with missed payments, they will likely offer you less favorable terms, such as higher interest rates.

- Deferring your loan: Some lenders may allow you to pause your payments temporarily, but you will still accrue interest and fees for late payments.

- Entering a hardship program: These programs may offer lower payments or temporary relief but can also harm your credit score.

It’s important to remember that every situation is different, and it’s best to contact your lender directly to confer your options if you are behind on loan payments. They can help you assess your situation and find the best solution.

What Happens if You Don’t Pay Back a Personal Loan?

What option will not be accessible if you are behind on loan payments? Not paying back a personal loan can have serious consequences, both financial and emotional. Here’s what you can expect:

Financial Impacts:

- Late fees and penalties: Most lenders charge late fees for missed payments, which can quickly add up and increase your overall debt.

- Damaged credit score: Each missed payment will significantly impact your credit score, making it more complex and more expensive to borrow money in the future. It can affect not just loans but also things like getting utilities or renting an apartment.

- Collections: After a certain period of non-payment, your creditor may sell your debt to a group work. These agencies will aggressively try to collect the debt, often through repeated phone calls and letters.

- Lawsuit and wage garnishment: In extreme cases, the lender may sue you to improve the debt. If you lose the lawsuit, the court may order wage garnishment, which means your employer will force you to withhold a portion of your paycheck to pay your debt.

- Tax implications: Sometimes, forgiven or discharged debt can be taxable.

Emotional Impacts:

- Stress and anxiety: Dealing with debt and the constant pressure from collectors can be very stressful and anxiety-inducing.

- Shame and guilt: Many people feel embarrassed and guilty for falling behind on their loans.

- Damage to relationships: Financial problems can strain relationships with family and friends.

What can you do? What option will not be available if you are behind on loan payments?

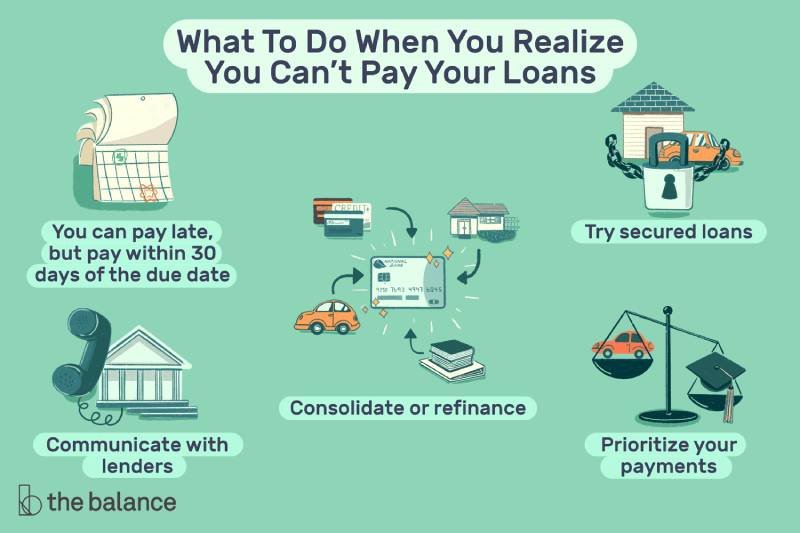

If you’re struggling to make your loan payments, acting quickly and proactively is important. Here are some options:

- Contact your lender: Explain your situation and see if they offer hardship programs or other options to help you get back on track.

- Consider debt consolidation: Combining your loan with other debts into a single loan with a lower interest rate can make your payments more manageable.

- Seek financial analysis: A credit counselor can help you create a budget and explore debt repayment options.

Remember, addressing the problem early is better than avoiding it altogether. The sooner you take action, the easier it will be to manage the consequences of missed payments and get back on track financially.

What benefits will I lose if you are behind on loan payments?

- Loan-specific benefits: Some loans include additional perks like loyalty programs, extended warranties, or travel insurance. These benefits might suspended or canceled if you fall behind on payments.

- General financial benefits: Maintaining a good credit history unlocks access to lower interest rates on future loans, better insurance premiums, and even specific employment opportunities. Falling behind on payments can damage your credit score and lead to higher costs in the long run.

- Government benefits: Depending on your location and specific circumstances, falling behind on certain types of loans (like student loans) could affect your eligibility for government benefits like income-based repayment programs or public assistance.

Once you clarify what kind of benefits you’re concerned about, I can provide a more precise answer about the potential consequences of missed loan payments.

Remember, communication with your lender is crucial in such situations. They can help you understand the consequences of missed payments and discuss potential solutions to get back on track.